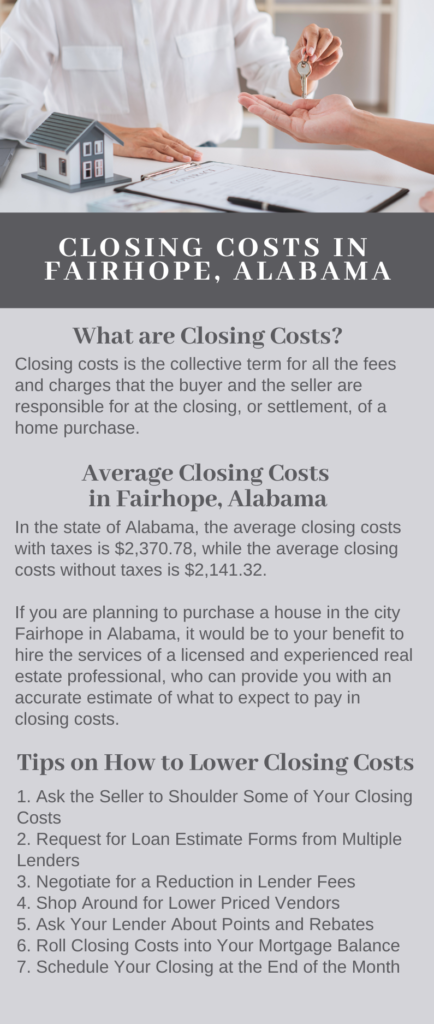

Closing costs, also known as settlement costs, is the collective term used to refer to all the fees and charges that a homebuyer and a seller are obligated to pay at the closing, or settlement, of a home purchase. Generally speaking, the buyer is responsible for most of the closing costs, but this is not set in stone. Negotiation may take place between the buyer and the seller, and the former may ask the latter to shoulder some, or even all, of the closing costs.

As to how much exactly closing costs are, this amount varies from state to state. In the state of Alabama, the average closing costs with taxes is $2,370.78, while the average closing costs without taxes is $2,141.32.

If you are planning to purchase a house in the city Fairhope in Alabama, it would be to your benefit to hire the services of a licensed and experienced real estate professional, who can provide you with an accurate estimate of what to expect to pay in closing costs. A realtor will also help ensure that you are properly guided on achieving the best deal out of your real estate transaction. Don’t worry about adding more to your closing costs by hiring an agent. Agent commissions are typically paid by the seller.

Credit: Image by Kindel Media | Pexels

Common Closing Costs for Alabama Home Buyers

Traditionally, certain costs are paid by one party or the other. However, it is important to note that buyers and sellers may agree during a negotiation who would pay which costs. To get a general idea of the fees and charges that buyers are obligated to pay, let’s take a look at common closing costs you can expect to encounter in Alabama.

Title Search

The title search is necessary to ensure that there are no liens or lawsuits in progress involving the property. The cost is often split between the buyer and seller at $100-$150 each.

Title Insurance

Buyers purchase title insurance as protection in case the title search missed something. Many mortgage companies require this as well. The cost varies depending on the home purchase price and the loan amount.

Loan Origination Fees

In Alabama, a large portion of buyer’s closing costs go to the mortgage loan origination fee. This fee is typically about 1% of the loan amount.

Discount Points

Discount points are a loan expense that buyers do not have to pay. However, you can save a lot of money in the long run if you negotiate with the mortgage company to lower your interest rate by purchasing points. The price varies depending on what the mortgage company would agree to.

Private Mortgage Insurance

Mortgage companies require private mortgage insurance for buyers who are not able to put down at least 20%. This serves as protection to lenders in case your home ends up in foreclosure. Fees generally range between 0.3% and 1.5% of the original loan amount.

Appraisal Fees

An appraisal is required by lenders because they want proof that the property you are buying is indeed worth what they are lending you. For a typical Alabama home, appraisal fees amount to around $450.

Escrow Fees

A closing fee or escrow fee ranging between $500 to $800 is charged by the title company to close the deal. This fee covers the escrow company’s expenses for managing the money during the purchase transaction. The cost is usually split between the buyer and the seller.

Attorney Fees

The state of Alabama requires an attorney to prepare the deed. Typically, attorney fees range between $75 and $100 and the cost is split between the buyer and the seller.

Taxes and Recording Fees

In Alabama, transfer taxes are $1 for every $1,000 of the home sale price. This is the responsibility of the buyer. Local taxes and fees may also apply.

Credit: Image by Mikhail Nilov | Pexels

Typical Home Seller Closing Costs in Alabama

When it comes to seller closing costs, a variety of different expenses are involved and are due and payable at the settlement of the transaction. Here’s a breakdown of the typical closing costs most sellers can expect:

Mortgage Fee

The mortgage fee varies depending on the lender. This includes the principal balance, a recording fee, interest accrued from the last payment, or any statement fee the lender might charge the seller.>

Real Estate Broker Commissions

Similar to other states, real estate agent commission fees in Alabama amount to about 5% to 6% of the home sale price.

Property Taxes

The seller is responsible for paying any outstanding bills, prorated property taxes, and homeowner’s insurance. They may need to pay the buyer a prorated amount of property taxes, or the buyer may need to credit this to them.

Attorney Fees

Real estate attorneys help manage and assist sellers on the purchase and sales contract, as well as prepare all legal documents during the closing process. In Alabama, the standard attorney fees range between $75 to $100 depending on the services provided.

HOA Dues, Document Fees

If the property falls under a Homeowners Association or a condo, the seller may have to pay HOA dues, a document fee at the beginning of escrow, and a transfer fee at the end of escrow.

Home Inspection and Repairs

Although it is the buyer who typically hires a home inspector to examine property defects, the seller can also do so. The usual cost ranges between $300 to $500.

Appraisal Fees

Hiring a professional appraiser to evaluate the cost or market value of the property usually costs around $200 to $300, depending on the location or area of the property.

How to Save on Closing Costs in Alabama When Buying a Home

If you are a first-time homebuyer, all these closing costs may seem quite overwhelming, but don’t worry. There are a few things you can do to keep your closing costs down as much as possible.

One of the things you can do is to look into the Alabama Housing Finance Authority’s assistance programs. If you are eligible, you can receive 3% down payment assistance. A good credit score of 620 or above is required and you also have to meet income and purchase price restrictions.

The state of Alabama also offers Mortgage Credit Certificates (MCC). You can use these for a federal tax credit which may amount to 20% to 50% of your mortgage interest.

Another way to save on closing costs is by being a good negotiator. Being a first-time homebuyer without any experience in real estate transactions, this is when the help of a professional real estate agent will be very helpful. A good buyer’s agent will help ensure that you get the best deal from your home purchase.

If you have plans of buying a home in Fairhope, AL, our team is here to help! Feel free to give us a call at 251-716-1421 or send us an email at hollie@localpropertyinc.com and we will be more than happy to answer your questions or schedule an appointment.